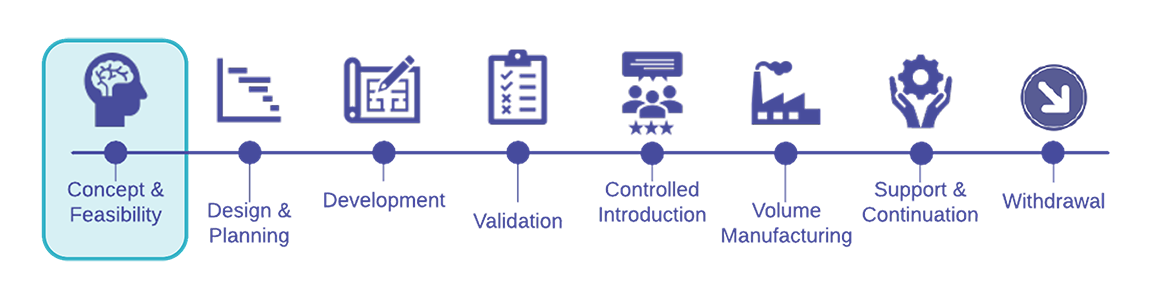

2. CONCEPT & FEASIBILITY PHASE – Part 1: Concept

In this series on developing a hardware product from idea to scale, we begin with the essential but often overlooked Concept & Feasibility phase. This blog explains the concept half of the process, which addresses the customer, competition, and costs of your product.

Why The Concept & Feasibility Phase Matters

Most products fail. Over 30,000 new products are introduced every year, and 95 percent fail, according to research by the late Harvard Business School professor, Clayton Christensen. While this may be unsettling news, most product failures are not actually a result of a product problem or the underlying technology. Industry veterans know that products fail because companies don’t invest the time to understand their market(s), customer pain point(s), costs, and competition. Furthermore, most companies waste time and resources developing products that do not meet their customers’ needs.

In the Concept & Feasibility Phase, successful entrepreneurs use research to solve the conundrum of whether an idea can become a profitable product.

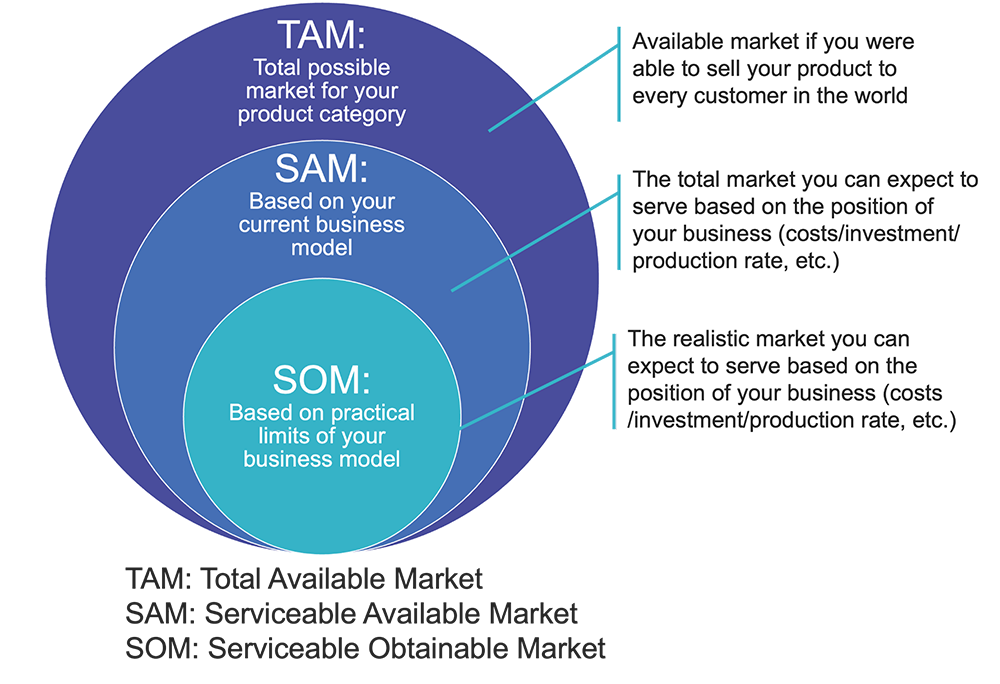

1. Calculate the Total Available, Serviceable and Obtainable Markets (TAM/SAM/SOM)

Whether you are an established company or startup, it’s important to understand the size of your target market.

The goal is to research and understand the Serviceable Obtainable Market (SOM) and the market segment you can realistically reach.

Once you prove there is a market for your first product, the additional revenue may be used to fund new product features and extensions to grow your business organically over time. Finally, if you are a startup that is looking to raise capital from a venture capitalist, having a large target market is essential, as institutional investors are looking for 10X returns.

2. Estimate the Product Development Costs

Early in the concept phase, it’s necessary to estimate the cost to develop a product and confirm these expenses are inline with your goals and budget. These costs may vary widely depending on product complexity, industry, and time to market. A sample breakdown of cost categories are listed below.

- Program management

- Cross-functional teams

- Operations

- Field service

- Finance

- Quality

- Industrial design

- Product development

- Mechanical/electrical/software

- Prototyping/product validation

- Product reliability and test

- Business process and systems

- Production tooling and fixturing

In the concept phase, the primary cost considerations are for product development. The costs of production parts and manufacturing will be considered later in the development cycle.

3. Identify the Customer Needs

While it is critical to understand the size of your market, it is equally important to assess your target customer needs. To gather insights and really understand your customers’ pain points, your product managers should go out and talk to them and ask a combination of specific and open-ended questions to gather both qualitative and quantitative data.

If you work at a B2B company, then you should talk to at least 10-20 potential customers, ideally more, to understand if their new product idea solves a significant problem that customers are willing to pay for.

Alternatively, if you work for a startup, Steve Blank’s customer development model is a useful guide. Blank recognized that startups are not smaller versions of large companies and developed a four-step process to help founders learn more about their customers and find product-market fit.

Regardless if your product is B2B or B2C, product conceptualization is an iterative process. So as you learn more about your customers, expect to either validate your underlying assumptions or pivot and look at solving a different problem.

4. Research the Competition

As part of this process, you need to understand the competitive landscape. For instance, does your idea have direct or indirect competition with similar products or customers with expertise to build an in-house solution. Most big markets are complex with several major players that offer a portfolio of products. So, the hard part of market research and customer discovery is to identify unmet needs, which may include a combination of new products, existing products, new features, or lower cost.

To maintain a competitive position, you need to think about things like:

- Software strategy

- IP Strategy

- Supply chain/logistics

- Roadmapping

- Portfolio management

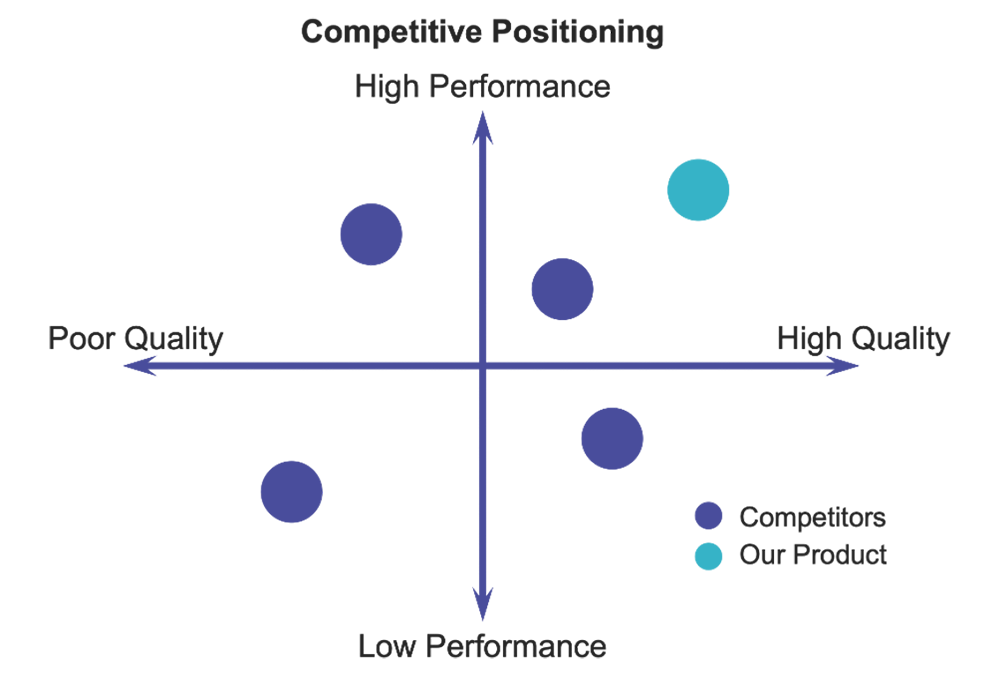

5. Position your Product

Once you have an understanding of your competition and are clear of unmet needs, it’s helpful to summarize your product positioning in graphic form. While there are many different frameworks and techniques to do this, a 2 X 2 can convey a lot of information in one image and show the relative positioning of your product with respect to others. To get deeper insights into your market position, create a couple of versions, and vary the X-Y axis as needed.

Typical parameters include:

- Cost

- Quality

- Performance

- Advanced features and benefits

In summary, investing in understanding the market, costs, customer, and the competition will lay the foundation for a successful new product introduction down the road. This critical step can make the difference between product success and failure.

Mike Freier is Founder and Principal Consultant at the Product Management Consulting Group Inc. He has 20+ years of experience with high-tech companies, including more than a decade in product management and product marketing. He was a long-time board member and President of the Silicon Valley Product Management Association, served on the MIT-Stanford (VLAB) executive planning committee and spent several years mentoring start-up founders at the Cleantech Open. Mike graduated from the University of Massachusetts at Amherst with a BSME degree.